georgia estate tax laws

Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Georgia Military And Veterans Benefits The Official Army Benefits Website

Georgias Estate Tax Repeal.

. And while no one enjoys paying taxes they help fund important public services such as roads public schools fire departments and other. Recording Transfer Taxes. According to the IRS the estate tax is a tax on your right to transfer property at death.

This tax is portable for married couples meaning that if the right legal steps. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Only people who die with more than 117 million must pay the federal estate tax and Georgia does not have any special taxes for estates or inheritances.

Georgia law allows an heir to request that the decedents estate skip probate entirely. Georgia Code 53-6-60 says that executors may be paid as stated in the will. During the most recent legislative session in.

Wealth is determined by the property a person owns. If a person that owned a home with a fair market value of 100000 in an unincorporated area of a county where the millage rate was 2500 mills that persons property tax would be 95000--. This is due by April 15 of the year following the individuals death.

Federal estate tax return. All Major Categories Covered. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

The bill has two main thrusts. Select Popular Legal Forms Packages of Any Category. This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at death and for jurisdictions currently imposing a state estate tax includes an overview of the.

Georgia law governs estate property transfers after someone dies. Taxes are unavoidable in any state. Understanding Georgia inheritance tax laws and rules can be overwhelming.

People who own real property must pay property taxes. Property tax is an ad valorem tax--which means according to value-- based upon a persons wealth. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million for 2022.

FindLaw Codes are provided courtesy of Thomson Reuters Westlaw the industry-leading online legal research. Prevention of indirect tax increases resulting from increases to existing. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

In addition he or she also has to file federal and state income tax returns for the decedent. Revised Uniform Fiduciary Access to Digital Assets. Georgians are only accountable for federally-mandated estate taxes in.

Georgia estate tax laws Sunday March 27 2022 Edit. The federal estate tax in its modern form was enacted in 1916 and has gone through significant changes. The changes to the estate tax laws on the federal and state level have helped to simplify tax issues and reduce taxes for beneficiaries.

This is due nine months after the individuals. The government uses the money. Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000.

Most states including Georgia have homestead protection laws allowing property owners to protect a small parcel of property from creditors and adverse possession laws which allow. A court-approved executor holds a probated estates assets and transfers them by executors deed to. In Georgia personal income tax laws offer lower rates for lower-income individuals.

If the estate doesnt have enough money to pay all debts claims have to be prioritized under Georgia. This is an expedited process that avoids complicated forms and numerous trips to. The assessed value--40 percent of the.

From Fisher Investments 40 years managing money and helping thousands of families. Local state and federal government websites often end in gov. Federal estatetrust income tax return.

Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax. The typical Georgian ends up paying over 9500 a year in taxes over half of which is going to federal income taxes. Georgia eliminated the requirement to file estate tax returns back on July 1 2014 when it changed its existing laws and declared that it would no.

If no amount was included in the will it would be 2-12 percent on all money received into the estate and 2-12. Just over 4000 of that bill is Georgia state tax including. The Department issues individual and generalized guidance to assist taxpayers in complying with.

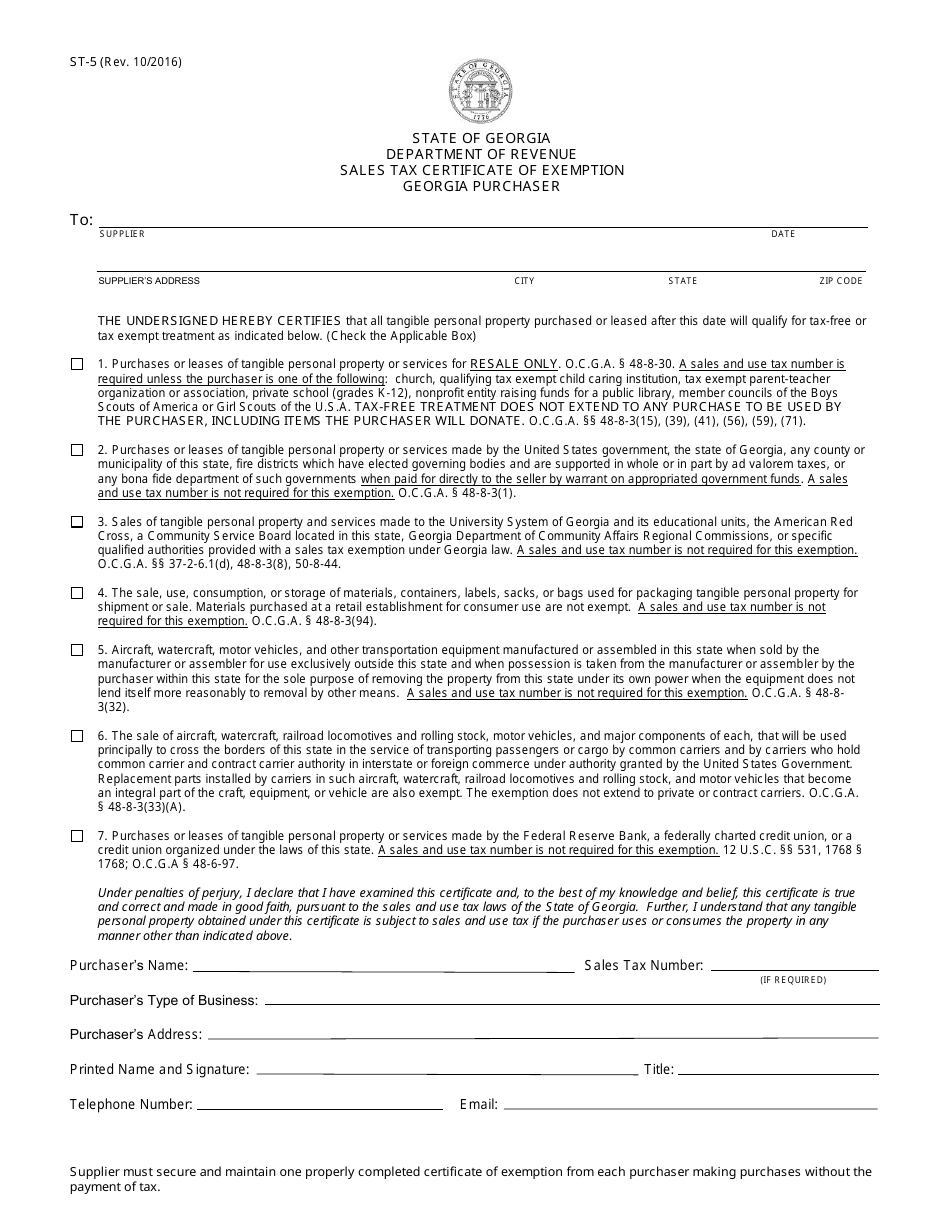

Sales Use Taxes Fees Excise Taxes.

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Georgia Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Georgia Retirement Tax Friendliness Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

Exemption Summary Richmond County Tax Commissioners Ga

Exemption Summary Richmond County Tax Commissioners Ga

Georgia Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Military And Veterans Benefits The Official Army Benefits Website

Georgia Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Create A Living Trust In Georgia Legalzoom Com

Georgia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die